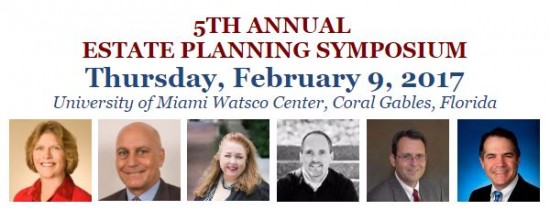

5th Annual Estate Planning Symposium

AGENDA

8:00 – 8:30am Breakfast, Registration and Networking with Sponsors

8:30 – 8:45am Welcome and Introductions

8:45 – 9:35am TRANSFERRING FAMILY VALUES IN ESTATE PLANS

JOAN K. CRAIN, CFP®, CTFA, TEP - Senior Director, Global Family Wealth Strategist, BNY Mellon - Ft. Lauderdale, FL

Much has been written about the importance of “family governance” to the successful intergenerational wealth transfer. However, there is still a dearth of practical techniques to address this idealistic concept. Moreover, since professional estate planning advisors tend to view this area as the purview of psychologists and family coaches, there is a disconnect between the implementation of “soft side” ideas and traditional estate planning based on legal contracts and tax minimization. This leads to various degrees of dysfunction and often undermines the best laid planning. This session will explore practical ways to integrate family dynamics with traditional estate planning structures and practices which will lead to better long term success in preserving and growing all aspects of a family’s wealth.

9:35 – 9:45am Break

9:45 – 10:35am INTEGRATING ASSET PROTECTION AND ESTATE PLANNING

BARRY A. NELSON, ESQ. - Shareholder, Nelson & Nelson, P.A. - North Miami Beach, FL

This presentation will highlight how advisors should assist clients to integrate estate and asset protection planning. Are fully funded revocable trusts appropriate? The discussion will include use of inter vivos QTIP trusts to enhance asset protection planning and achieve income tax basis step ups with terminally ill clients and why Florida third party created trusts are not safe from garnishment in favor of former spouses.

10:35 – 10:55am Break and Networking with Sponsors

10:55 – 11:45am TRUSTS AS IRA BENEFICIARIES: THE MORE THINGS CHANGE, THE MORE THEY STAY THE SAME

KRISTEN M. LYNCH, ESQ. - Partner, Lubell Rosen - Fort Lauderdale, FL

IRAs have always been a bit of a challenge to work with in estate planning due to the income tax consequences. Although there have been very favorable rules in place for almost the last 15 years, there continue to be a number of common but costly avoidable mistakes made when naming a trust as the beneficiary of an IRA. The purpose of this presentation is to point out the obvious, the not-so-obvious, and the avoidable pitfalls associated with leaving IRAs in trust.

11:45am – 1:00pm Luncheon and Networking with Sponsors

1:00 – 2:40pm RECENT DEVELOPMENTS IN FEDERAL ESTATE, GIFT, AND INCOME TAXATION

PROF. SAMUEL A. DONALDSON, J.D., LL.M. (TAXATION) - Georgia State University College of Law - Atlanta, GA

This informative and entertaining session will cover the significant federal income, estate, and gift tax cases, rulings, regulations, and legislation from the past twelve months of interest to estate planning professionals. We will identify recent federal tax developments affecting attendees’ practices; and apply recent developments in the federal tax field to matters affecting your clients.

2:40 – 3:00pm Break and Networking with Sponsors

3:00 – 3:50pm IMPACT OF THE NEW DOL FIDUCIARY RULES ON WORKING WITH QUALIFIED RETIREMENT ASSETS

AL KINGAN, JD, LLM, CLU, CHFC - Asst. VP, Estate and Business Planning Dept., MassMutual Financial Group - Phoenix, AZ

The new Department of Labor Fiduciary Rules will have a significant impact on the operations and compensation of financial advisors. The presentation will review the DOL justification for creating the rules, provide an overview of the rules, and the broad scope of the rules. The presentation will also review and define the regulatory exemptions that will allow advisors to continue to be able to be compensated when working with qualified dollars. This will include defining the “Best Interest Standard” and the “Best Interest Contract” or “BIC”, the revised exemption standards under 84-24, and what eliminating conflicts of interest will actually entail. Finally, we’ll look at how the industry is responding to these requirements and changes.

3:50 – 4:00pm Break

4:00 – 4:50pm ESTATE, GIFT, GST AND INCOME TAX PLANNING ISSUES & COMPLIANCE REQUIREMENTS FOR ASSET PROTECTION TRUSTS

JONATHAN GOPMAN, ESQ. - Chair, Trusts, & Estates Practice, Akerman LLP - Naples, FL

The creation, funding and annual administration of both domestic and foreign asset protection trusts often presents complex tax issues for practitioners to consider and may require the preparation and filing of one or more tax forms. This complexity also breeds opportunity when practitioners understand these rules and enables clients to achieve far broader planning objectives.

4:50 – 5:00pm Conclusion

Approved for 7 hours of FL CLE credit (Certification: 7 hours elder law; 7 hours wills, trusts & estates; 7 hours tax law)

Accepted for 7 hours of CFP CE credit

Approved for 7 hours of Florida CE insurance credit

Approved for 7 CTFA credits

Qualifies for 7 hours of CPE credit for CPAs

Qualifies for 7 hours of PACE CE credit (CLU, ChFC)

HOW TO REGISTER

EPC 2017 Symposium Registration Form

-

Download and fax or email Symposium registration form, then pay online via PayPal or credit card – Click BUY NOW below.

-

Download and mail Symposium registration form with check payable to EPC of Greater Miami or credit card information to EPC of Greater Miami, c/o Manageability, 1821 Hillandale Rd., Suite 1B-320, Durham, NC 27705-2659

-

Download and fax Symposium registration form with credit card information to 919-287-2711

-

Download and email Symposium registration form with credit card information to info@epcmiami.org