The USA v. The World—Wealth Preservation Trusts (Dinner) Case Study of a Complex Fiduciary Income Tax Return – Form 1041 (Workshop) The “Silver Tsunami” and the Effect on Senior Housing (Pre-Workshop)

Dinner Sponsored by:

Pre Workshop

The “Silver Tsunami” and the Effect on Senior Housing

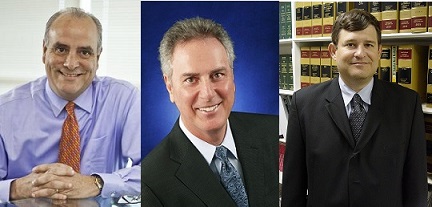

Raul Mas Canosa

United Homecare

Dinner Presentation

This presentation will review the respective benefits, burdens and practical considerations of domestic and offshore irrevocable asset protection structures. It will also discuss one particular IRS sanctioned structure (the so-called “emergency funds trust” that can provide wealth preservation, estate planning and US tax benefits.

Speaker Biography

Leslie A. Share, a shareholder in Packman, Neuwahl & Rosenberg, P.A., specializes in the areas of domestic and international tax, corporate, estate and business planning, and wealth preservation. Mr. Share received his B.A. from Northwestern University, his J.D., with honors, from the University of Florida (where he served as the Law Review Research Editor and Chief Tax Editor), and his Master of Laws in Taxation from New York University. He has served as an adjunct professor at the University of Miami School of Law. He is AV rated by Martindale-Hubbell, a Florida Super Lawyer in the field of tax law, and listed in Top Attorneys in Florida and Best Lawyers in America.

Workshop Presentation

Multiple trust Section 645 elections to file combined with Estate and use of fiscal year to defer income tax; S-Corp trade or business income and “material participation” of fiduciary; Net Investment Income Tax considerations; Electing Small Business Trust (ESBT) and Qualified Subchapter S Trust (QSST) issues; Section 6166 estate tax deferral effects; multiple “separate shares”; income tax treatment of large commercial annuities; Income In Respect of Decedent (IRD); Section 691(c), Estate Tax Deduction related to IRD; Fiduciary Accounting Issues.

Speaker Biography

John R. Anzivino joined Kaufman Rossin in 1984 and leads the Firm's estate, trust and exempts organization practice. He began working in the estate and trust field in 1972 and spent 7 years as a trust officer administering estates and trusts at Southeast Bank and 5 years in the tax practice at Coopers and Lybrand prior to joining the Firm.

He is a Certified Public Accountant in Florida and a member of the Florida Institute of Certified Public Accountants, American Institute of Certified Public Accountants, Partnership for Philanthropic Planning (formerly known as the Planned Giving Council), and the Estate Planning Council of Miami-Dade County. He is also the founding president of the Partnership for Philanthropic Planning of Miami-Dade.

John has served on the College Assistance Program (CAP) board of directors for over 30 years, including two terms as President. He has also served as the Campaign Treasurer for Judge Marie Korvick. He also has current or former significant involvement with the following organizations: The Miami Foundation, The Red Cross, Labrador Rescue and the University of Miami.

John earned a Master’s degree from the University of Miami. He has served as adjunct professor at the University of Miami Law School Masters in Taxation program and is a frequent lecturer for various professional groups. John was the recipient of the 2001 Professional Advisor of the Year Award from the Planned Giving Council.